Reinsurance PCC

Protected Cell Companies

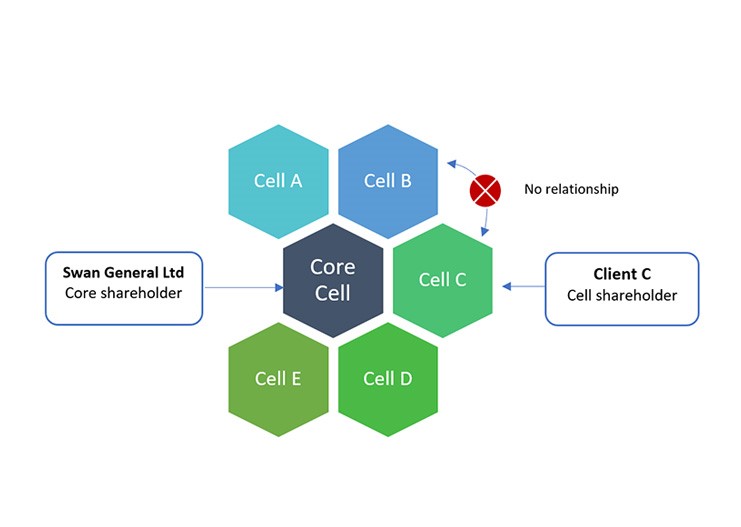

Some organisations use traditional insurance to manage their risks but others with more complex needs have to consider alternatives. Swan Re offers an alternative through protected cell captive facilities, where each vehicle is legally segregated. These cells can be used by clients who wish to have a direct-writing or reinsurance facility without establishing a separate captive insurance company. This is a growing area helping businesses achieve their strategic goals.

PCCs are created with a special legal structure that comprises core capital, assets and liabilities, as well as cellular capital, assets and liabilities. This structure enables segregation and ring-fencing of assets and liabilities of each cell.

The profitability, or otherwise, of one cell does not affect the other cells; indeed, the solvency of each cell is determined and maintained separately.

The protected cell company is a single legal entity.